![]() Published: 07/11/2025

Published: 07/11/2025

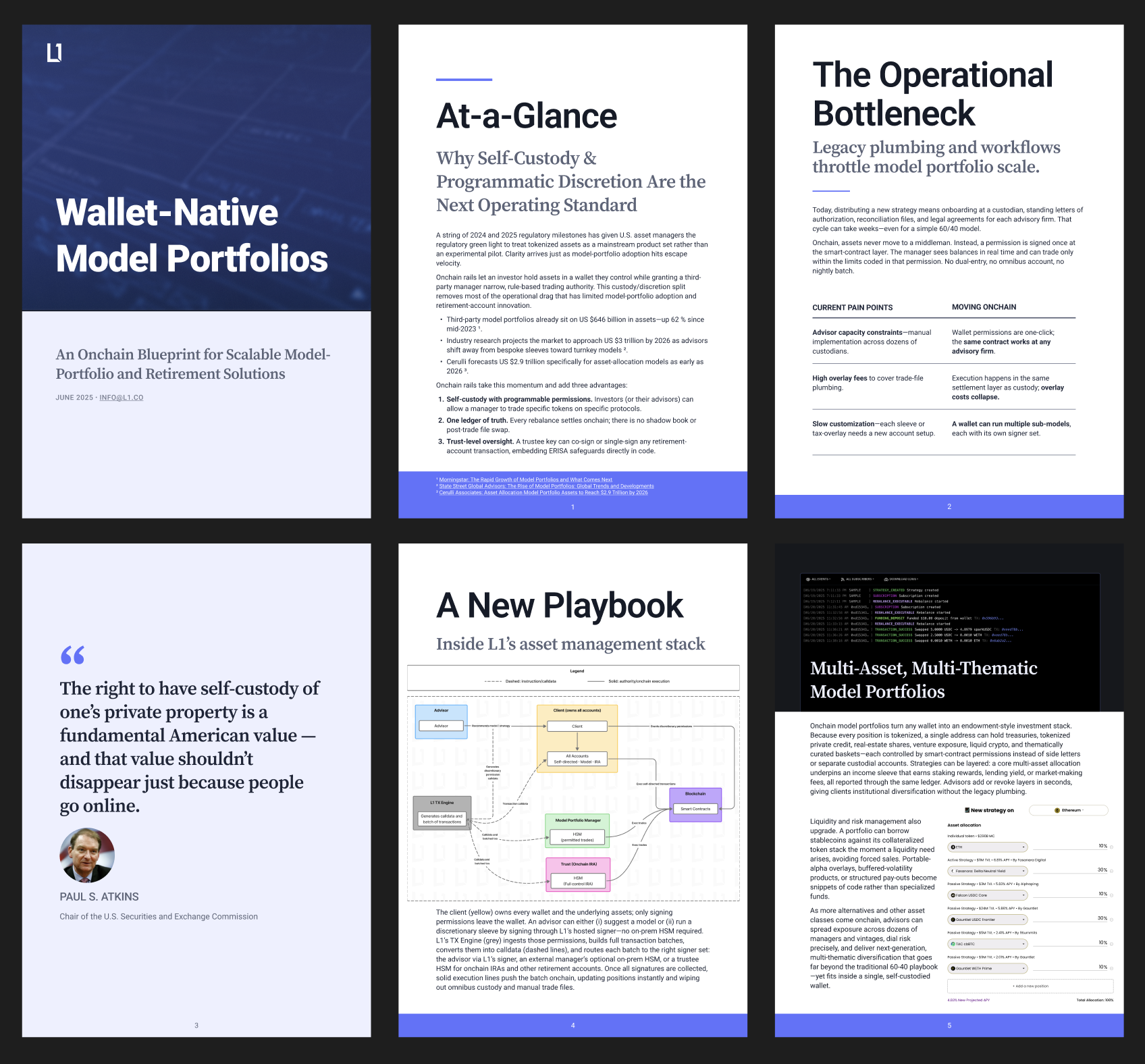

Traditional model portfolios gave advisors efficient diversification but always required either full custody or a complex patchwork of accounts. Our new Onchain Model Portfolios remove that trade-off and supercharge their capabilities leveraging onchain rails and Decentralized Finance protocols. Every asset is held entirely onchain and under individual client custody, while L1 handles all transaction execution. Managers pick the asset allocation, set the weights, and let us handle the rest.

1. Portfolio Construction: Assemble a model portfolio that blends

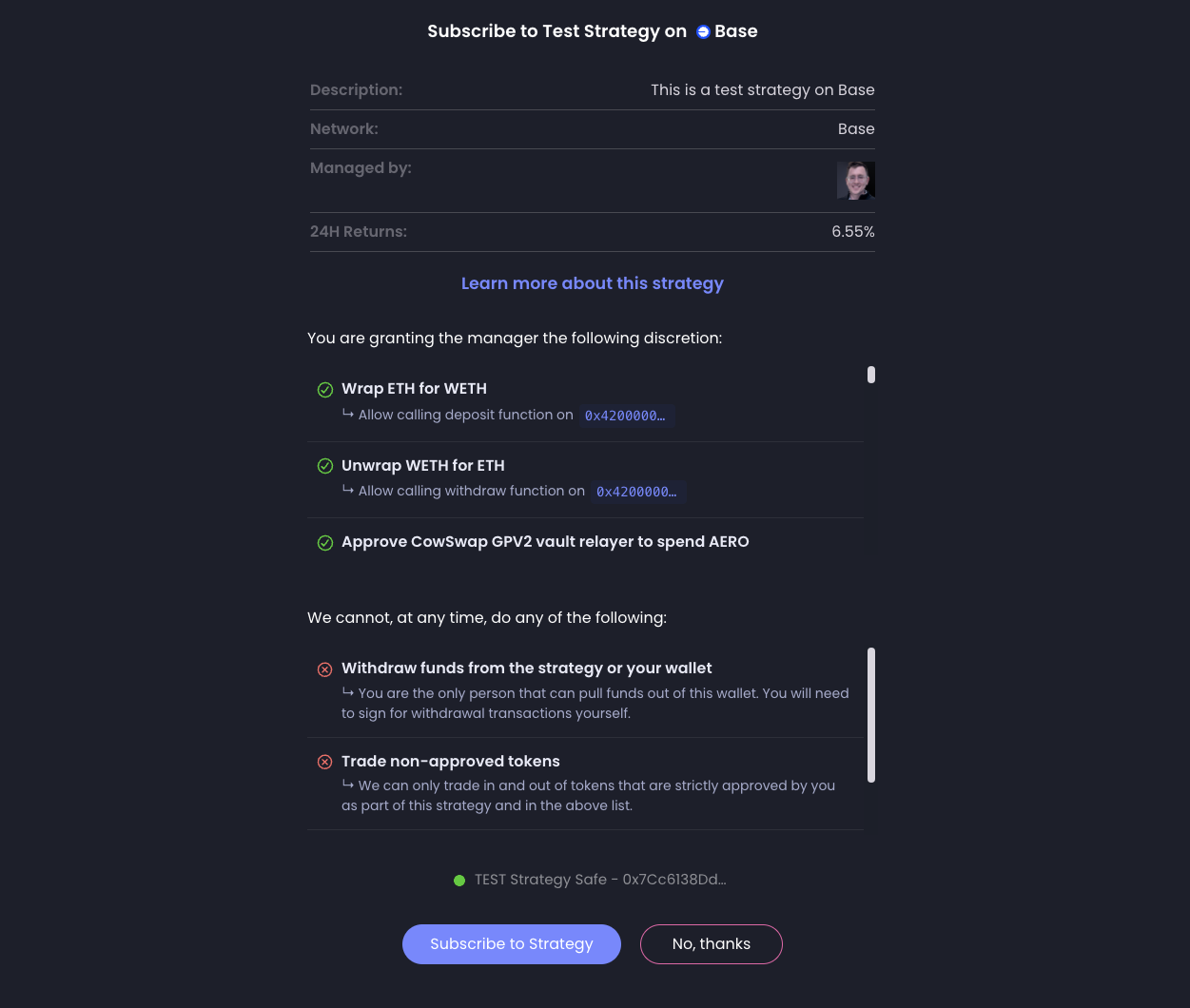

2. Permissioning & Smart-Contract Discretion: As soon as you publish or pick a model, L1 spins up a dedicated Safe-powered, smart-contract wallet for every subscriber. Investors grant that wallet—and only that wallet—permission to execute transactions strictly within the mandate defined, with rules enforced at the smart-contract level. L1 also offers on-premise infrastructure solutions for managers to fully control the signing of transactions queued up by L1's rebalancing engine.

3. Self-Rebalancing in One Click: Adjust weights in your dashboard, click Update, and L1’s rebalancing engine automatically queues the required trades across every investor wallet. Each transaction settles onchain in real time and feeds straight back into your performance dashboard.

4. Seamless Funding & On-Ramp: For every new subscription, L1 opens a U.S. bank account in the investor’s name with its own routing and account number. Incoming wires or ACH deposits are auto-converted to USDC and deployed into the model instantly. Clients can also fund in-kind—transferring USDC or tokens from an external wallet—and the engine allocates them according to your target weights.

Design the model, set the rules, and let the system do the heavy lifting—so you can focus on generating alpha, not running ops.

Build a simple, long-only token portfolio or a sophisticated fund-of-funds that mixes yield farming, delta-neutral basis trades, and long-short DeFi hedge-fund mandates. Because each strategy is just another onchain position, combining them is as easy as assigning weights.

Every action is strictly executed onchain. Clients can watch allocations update live, withdraw at any time, and verify that L1 never steps outside the mandate they approved since everything is enforced at the smart-contract level.

From the Strategy builder, pick your assets or strategies, set your weights, and publish. We will spin up the wallets, handle the wires, and execute every rebalance while you focus on delivering investment insight instead of back-office ops.

Finally, discretionary management with non-custodial peace of mind.

Click here to download our white paper on Onchain Model Portfolios.