![]() Published: 06/21/2024

Published: 06/21/2024

This post is the shorter version of Miguel's contribution to CoinDesk, which can be found here: https://www.coindesk.com/business/2024/10/09/the-shopification-of-wealth/

Here's my prediction: There will be 1 million Registered Investment Advisors in the US by 2034, up from the 15,000 RIAs that exist today.

Before Shopify, building and running an e-commerce site was expensive, operationally intensive, and a logistics nightmare. Only large retailers could afford to build and operate an online store that could truly serve a national, let alone global customer base. This made e-commerce look like a small market. Not because of a lack of interest from would-be online shoppers, but because there just wasn’t a big or interesting enough pool of online stores. By eliminating the supply constraints (enabling anyone with a product to create and scale an online store globally with just a few clicks), Shopify unlocked a huge new market, worth $84B as of today.

Back to financial advisory

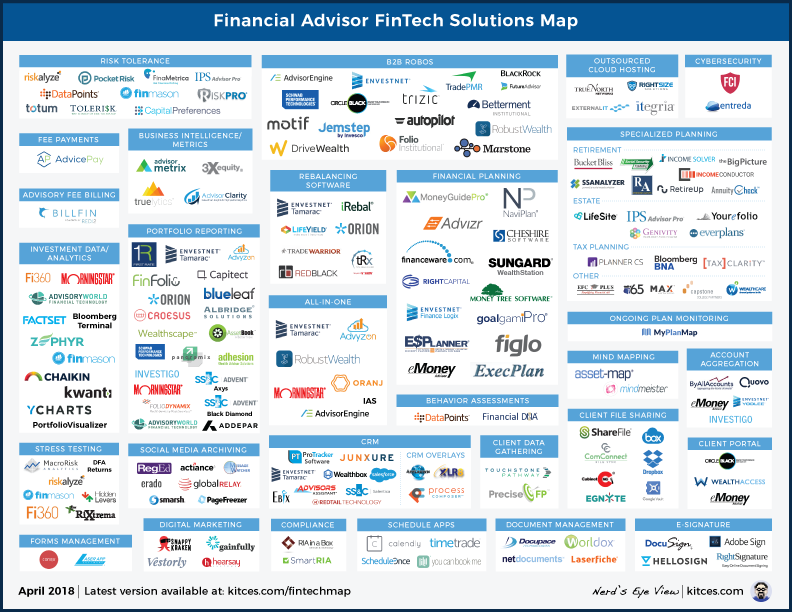

Image source: https://www.kitces.com/blog/financial-advisor-software-survey-ratings-market-share-fintech-wealthtech-landscape-chart/

Launching, operating, and scaling an RIA is much harder today than e-commerce ever was, and yet, advisors are responsible for half of all wealth in the United States. That’s over $50 trillion in investable assets managed by 15,000 RIAs. Qualifications and licenses are just a small part of an ever-growing checklist an aspiring financial advisor needs to satisfy to go into business, regardless of competence. Wealthtech is incredibly fragmented. Custodians are dinosaurs that create lock-ins and impose significant operational, legal, and compliance requirements. Endless layers of intermediaries also require additional overhead just to keep the lights on. This is why we’ve seen increased consolidation of players in the space, with small RIAs being acquired by larger RIAs that take advantage of their existing infrastructure and their economies of scale to grow their AUMs and revenue through M&A. The generational transfer of wealth from boomers to millennials and zoomers will challenge this strategy. Younger investors are disillusioned by traditional financial players. They are digitally native, and expect their money and assets to be the same. An oligopoly of RIAs controlling a bulk of the nation’s wealth only resembles the institutions those investors have run away from. And this is perhaps the biggest opportunity the industry has seen since the creation of the 401(k). 52 million Americans own crypto. Experiencing the freedom and power of holding their assets onchain often changes the way they see offchain assets - in other words, assets that can only be accessed from legacy platforms. This power and freedom now extends to financial advisors. For the first time, advisors can work with clients and advise them on assets that always remain under the custody of the client. In a world where clients bring their own wallets, the barrier to try out an advisor’s services is extremely low, leveling the playing field for advisors to compete on actual value creation as opposed to overhead and infrastructure, now largely abstracted away.

So we are about to see a new breed of RIAs coming onchain to increasingly serve this growing crypto-native clientele. Much like anyone can now start an e-commerce site with Shopify, any licensed and competent financial professional will be able to advise clients onchain. And the winners will be the investors who will have an open, transparent, and verifiable world of expert advice to choose from or combine to best suit their financial goals and needs.